Study and work in Poland / Europe

Top

Programs

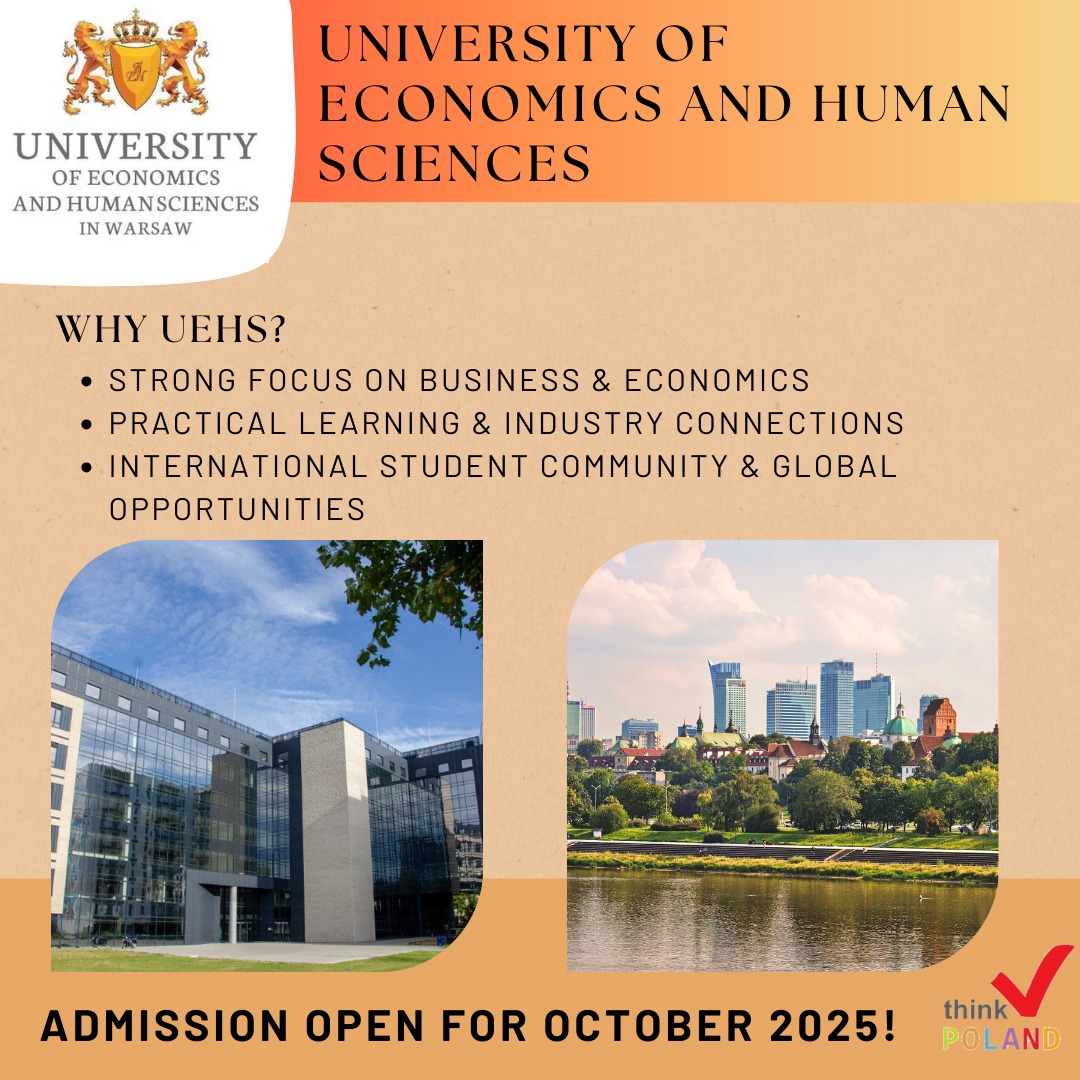

With over 15 years of experience, Think Poland helps students from around the world find the best educational paths in Poland. Below is a list of programs most frequently chosen by our students.

We analyze each inquiry individually, adjusting options to your needs and budget. With us, you’ll discover your potential and start your study in Poland!

Top Programs

-

BUSINESS MANAGEMENT BACHELORview programs

BUSINESS MANAGEMENT BACHELORview programs -

INFORMATION TECHNOLOGY MASTERview programs

INFORMATION TECHNOLOGY MASTERview programs -

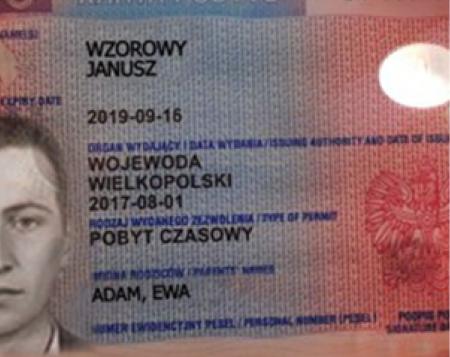

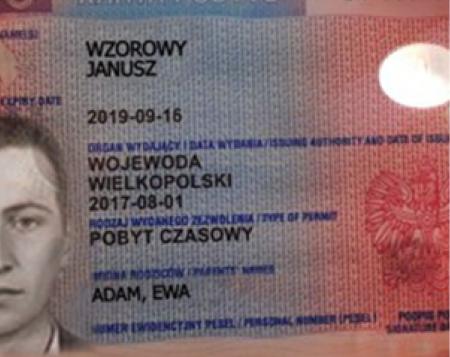

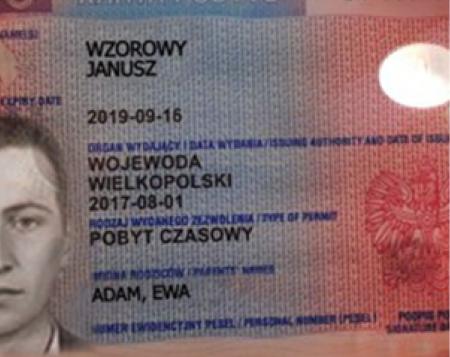

TEMPORARY RESIDENCE CARD (TRC)view

TEMPORARY RESIDENCE CARD (TRC)view -

ENGINEERING MASTERview programs

ENGINEERING MASTERview programs -

LIFE SCIENCEview programs

LIFE SCIENCEview programs -

TRAVEL TURISM BACHELORview programs

TRAVEL TURISM BACHELORview programs -

BUSINESS MANAGAMENT MASTERview programs

BUSINESS MANAGAMENT MASTERview programs -

TRAVEL & TOURISM MASTERview programs

TRAVEL & TOURISM MASTERview programs -

HEALTH CARE MASTERview programs

HEALTH CARE MASTERview programs -

SCIENCE MASTERview programs

SCIENCE MASTERview programs -

HUMANITIES MASTERview programs

HUMANITIES MASTERview programs -

BUSINESS MARKETING BACHELORview programs

BUSINESS MARKETING BACHELORview programs -

BUSINESS MANAGEMENT BACHELORview programs

BUSINESS MANAGEMENT BACHELORview programs -

INFORMATION TECHNOLOGY MASTERview programs

INFORMATION TECHNOLOGY MASTERview programs -

TEMPORARY RESIDENCE CARD (TRC)view

TEMPORARY RESIDENCE CARD (TRC)view -

ENGINEERING MASTERview programs

ENGINEERING MASTERview programs -

LIFE SCIENCEview programs

LIFE SCIENCEview programs -

TRAVEL TURISM BACHELORview programs

TRAVEL TURISM BACHELORview programs -

BUSINESS MANAGAMENT MASTERview programs

BUSINESS MANAGAMENT MASTERview programs -

TRAVEL & TOURISM MASTERview programs

TRAVEL & TOURISM MASTERview programs -

HEALTH CARE MASTERview programs

HEALTH CARE MASTERview programs -

SCIENCE MASTERview programs

SCIENCE MASTERview programs -

HUMANITIES MASTERview programs

HUMANITIES MASTERview programs -

BUSINESS MARKETING BACHELORview programs

BUSINESS MARKETING BACHELORview programs -

BUSINESS MANAGEMENT BACHELORview programs

BUSINESS MANAGEMENT BACHELORview programs -

INFORMATION TECHNOLOGY MASTERview programs

INFORMATION TECHNOLOGY MASTERview programs -

TEMPORARY RESIDENCE CARD (TRC)view

TEMPORARY RESIDENCE CARD (TRC)view -

ENGINEERING MASTERview programs

ENGINEERING MASTERview programs -

LIFE SCIENCEview programs

LIFE SCIENCEview programs -

TRAVEL TURISM BACHELORview programs

TRAVEL TURISM BACHELORview programs -

BUSINESS MANAGAMENT MASTERview programs

BUSINESS MANAGAMENT MASTERview programs -

TRAVEL & TOURISM MASTERview programs

TRAVEL & TOURISM MASTERview programs -

HEALTH CARE MASTERview programs

HEALTH CARE MASTERview programs -

SCIENCE MASTERview programs

SCIENCE MASTERview programs -

HUMANITIES MASTERview programs

HUMANITIES MASTERview programs -

BUSINESS MARKETING BACHELORview programs

BUSINESS MARKETING BACHELORview programs

Verified Reviews

Selamlar! Normalde danışmanlık yapan şirketler belli işleri yaptıktan sonra öğrencilerle fazla ilgilenmezler fakat Think Poland bu yargımı tam anlamıyla kırdı. Gerek havaalanı karşılamasından gerek kalacağımız yerlere eşlik edilmesinden,banka hesabı açma,oryantasyon,kayıt işlemleri,sağlık sigortası,oturum izni...Her türlü konuda inanılmaz yardımcı oluyorlar.Mail ve mesaj yoluyla hemen kendilerine ulaşabiliyor ve her konuda bilgi alabiliyorsunuz asla yarı yolda kalmıyorsunuz. Danışman olarak benimle alakadar olan Enes Bey gerçekten çok profesyonel ve işinizle alakalı her detayı sizinle anında paylaşıyor ve çok kibar

Polonya`ya geldiğimizde kalacağımız geçici yeri bulmaya ve hatta havaalanından oraya ulaşmaya, kalıcı yerimizi bulmaya, banka hesabı açmaya, telefon hattı almaya, aklınıza gelebilcek küçük ya da büyük ama çok temel olan her şeye çok yardımcı oldular. Daha sonrasında oturma kartı işlemlerimizde yardımcı oldular, okulla ilgili problemlerimize çözüm bulmaya çalıştılar. Özellikle şu günlerde aşı ile ilgili sorularımıza her zaman cevap veriyorlar. Think poland ekibinin yardımları yalnızca geldiğiniz ilk günlerde değil ihtiyaç duyduğunuz her anda oluyor.

Really good and professional organisation with nice people working in it. There are lot to uncover when it comes to end to end process of a student coming abroad and they do it with ease and effortless for us. They take ownership for the students and answer and help them to understand why and where the things are done rather than pushing us to do meaningless things like other student agencies. They provide extra care and support for those who needs it. Highly recommended and special mention to Marcin and Aylene for being absolutely amazing in the organisation :)

Think Poland took care of the procedure every day, even before I came to Warsaw. When I came to Warsaw, I had no worries because I knew that with Think Poland I would take care of everything. I would like to thank the whole Think Poland team, especially Murat Birlik and brother Melih. I don't know what I would have done without Think Poland. They are still more closely involved my procedure. Thanks to Think Poland, we made my university application and was accepted. Thank you again. I highly recommend Think Poland to everyone.

Thank you, Think Poland(TP) for your excellent service. I was given a brief walk-through of the entire process and TP professionals guided me with all the things I needed to do, and everything went extremely well. I did not even feel pressured and stressed out during the entire process. I was relieved from all the stress of processing and it was a smooth transition. I appreciate all your efforts and I’d highly recommend your service to others. Thanks, highly recommended.

An excellent educational consultancy service. They provided friendly and helpful service from the moment of my arrival in Poland until the last moment. Thanks to their professional help during my university application process, I started my education. After my university application, they always helped with issues such as accommodation and living in a new city etc. Thank you so much Think Poland!

An excellent educational consultancy service. They provided friendly and helpful service from the moment of my arrival in Poland until the last moment. Thanks to their professional help during my university application process, I started my education. After my university application, they always helped with issues such as accommodation and living in a new city etc. Thank you so much Think Poland!

Since I arrived in Warsaw, as a foreigner, I have been experiencing different problems every day. That is, until I met ThinkPoland. Thanks to the support and advice I received from them, I carried out all my work in a reliable, official and fast manner. The whole team is very friendly. I am especially grateful for Mr. Murat's attention. Thank you all for everything!

Very professional firm, I went there to get help with my Temporary residence card and my overall process was very smooth as I had zero difficulties. They explain every process in details. Highly recommended if you want to get Temporary residence card. Just go there and the rest they will handle for you.

Before I arrived, my head was filled with dozens of questions. How do I find a place to stay, how to handle school work, how can I get used to Poland etc. But since the minute my plane landed in Poland, they have helped me so much so I could easily adapt. I would like to thank the Think Poland team.

Daha önce bir çok danışmanlık şirketiyle çalışmış biri olarak söylüyorum çok kaliteli bir hizmet veriyorlar. Danışmanım Murat bey bütün süreçte bana yardımcı oldu ve titizlikle ilgilendi. Burdan tekrar teşekkür ederim. Kaliteli hizmet ve kaliteli iletişim.

I would like to thank them very much for always supporting me from the moment I stepped into Poland and I recommend their services to everyone. Also, I would like to thank Enes Bey and Aylin Hanım for their help about residence card process and enrollment to school.

I used their services for a semester and I am really satisfied. I did not even touch for registration and apply. I just signed and sent them. Especially I am greatful for Murat’s help, thank you guys for everything. Highly Recommend 👍🏼👍🏼👍🏼

Polonya`ya geldiğimden beri her konuda titizlikle yardım ederek buraya alışma sürecimi çok kolaylaştırdılar. Aynı zamanda şuan üniversite tercihlerim konusunda Murat Bey güzel tavsiyelerde bulunarak bana yardımcı olmuştur.

The staff here are enthusiastic, responsible, friendly and considerate. They can help you solve any problems you encounter. Being with them is like being with family. The atmosphere is very good. You will not regret choosing them.

I used their services for a semester and I am really satisfied. I did not even touch for registration and apply. I just signed and sent them. Especially I am greatful for Murat’s help, thank you guys for everything.

Çok başarılı ve gerçekten her konu da çok yardımcı oluyorlar herkese tavsiye ederim. Really friendly and nice place everyone was very helpful.💯

Many thanks to Think Poland specialty to Dr. Marcin Wysokiński for assisting my son to continue his studies in POLAND

these quys are quick fast and efficient .... i reccomend hundred percent.

they work very professionally, thanks especially to Mr. murat

Inspiring and safe